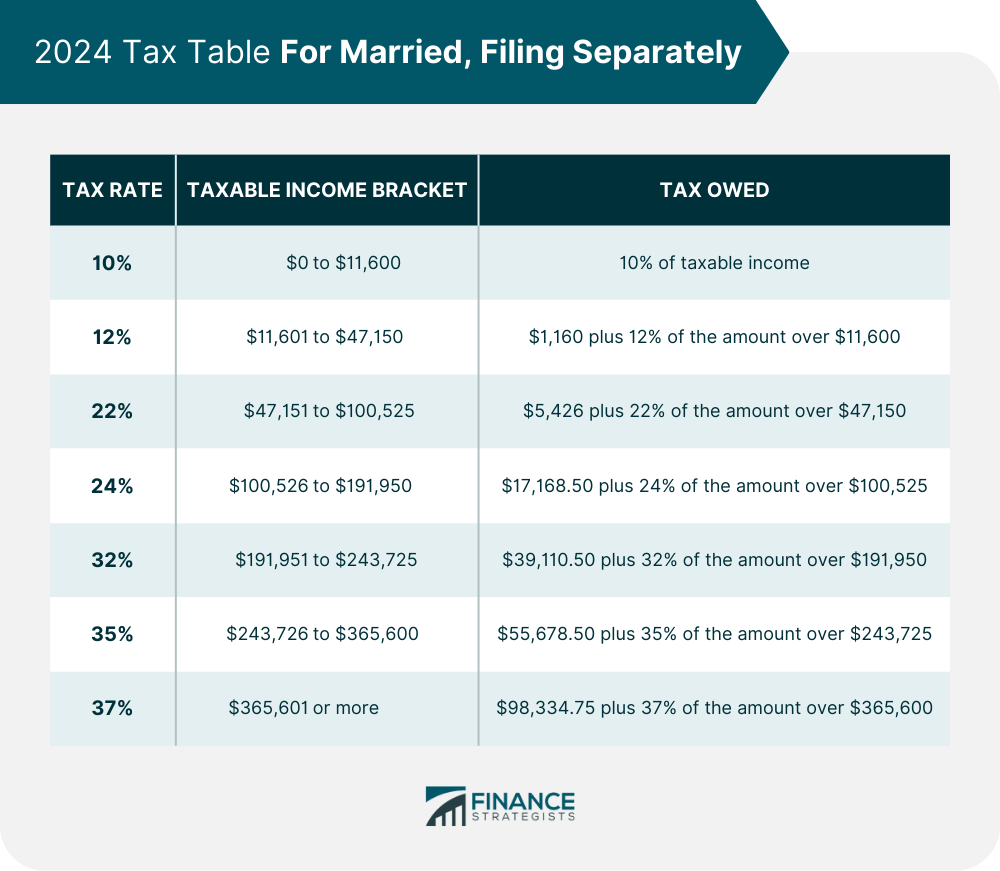

2024 Tax Brackets Married Filing Separately

2024 Tax Brackets Married Filing Separately. As your income goes up, the tax rate on the next layer of income is higher. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. How many tax brackets are there?

The Top Tax Rate For 2024 Will Remain At 37% For Individual Single Taxpayers With Incomes Greater Than $609,350, Or $731,200 For Married Couples Filing Jointly.

Federal income tax is calculated based on seven tax brackets, which depend on the taxpayer’s income and tax filing status.

How Does “Married Filing Separately” Work?

More guides and other resources.

Married Filing Separately 2024 Tax Brackets.

Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

Tax Brackets Definition, Types, How They Work, 2024 Rates, How does “married filing separately” work? Following are the 2024 income brackets and tax rates.

Source: hopevirals.blogspot.com

Source: hopevirals.blogspot.com

Married Filing Jointly Tax Brackets 2022 2022 Hope, Following are the 2024 income brackets and tax rates. In 2023 and 2024, there are seven federal income tax rates and brackets:

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 2023 and 2024 tax brackets and federal income tax rates. You pay tax as a percentage of your income in layers called tax brackets.

Source: guidingwealth.com

Source: guidingwealth.com

Tax Changes for 2024 What You Need to Know Guiding Wealth, The seven federal tax bracket rates range from 10% to 37% 2023 tax brackets and federal income tax rates. Following are the 2024 income brackets and tax rates.

Source: atonce.com

Source: atonce.com

50 Unveiled Benefits of Married Filing Separately Ultimate Guide 2023, File your federal and federal tax returns online. More guides and other resources.

Source: www.bluechippartners.com

Source: www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners, The 2024 standard deduction amounts are as follows: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Source: avocadoughtoast.com

Source: avocadoughtoast.com

How to Do Your Own TaxesA Beginners Guide, Below are some highlights for 2024. See current federal tax brackets and rates based on your income and filing status.

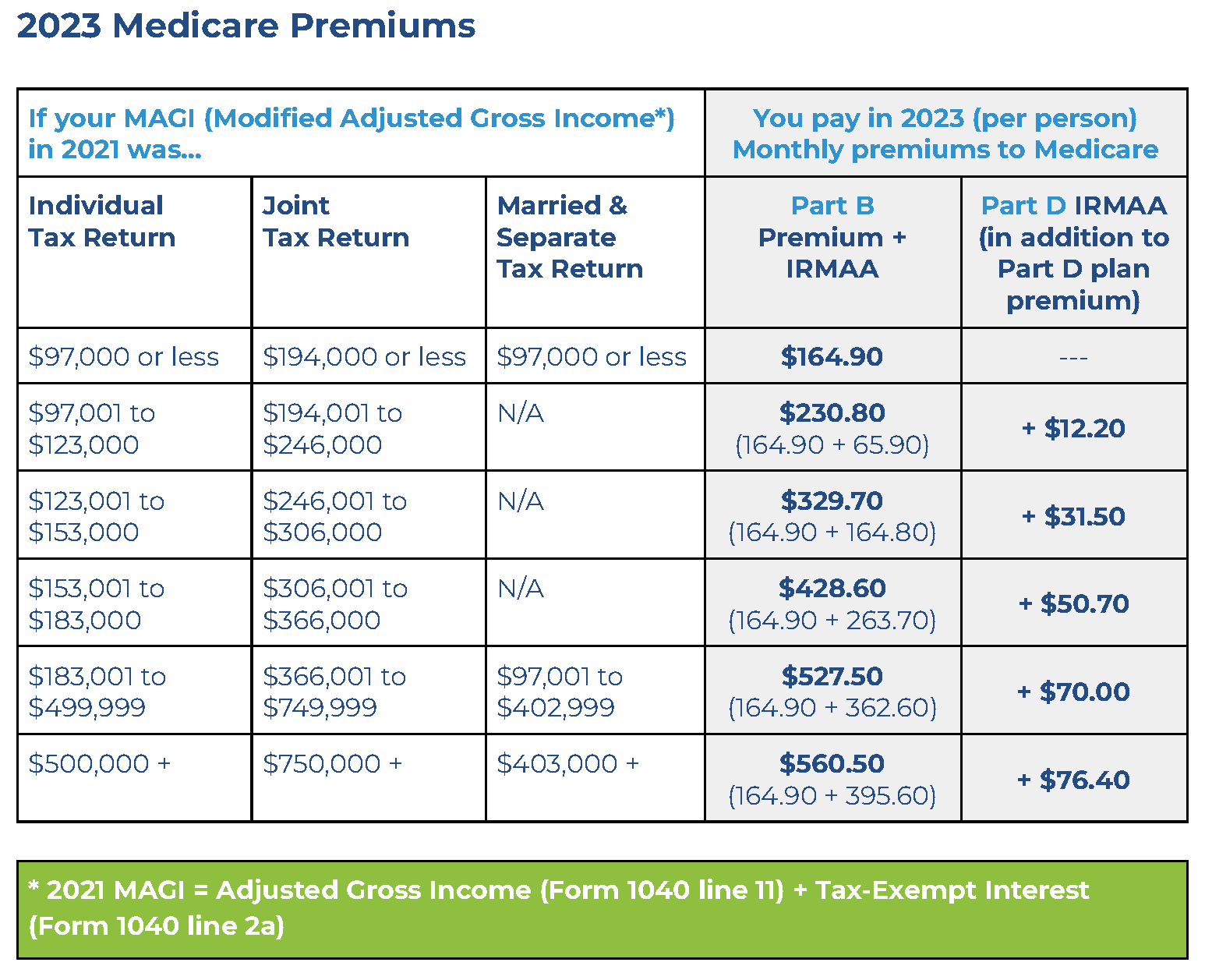

.png) Source: www.medicaremindset.com

Source: www.medicaremindset.com

Why Filing Taxes Separately Could Be A Big Mistake (when on Medicare, Below are some highlights for 2024. Knowing your federal tax bracket is essential, as it.

Source: dorolisawsusie.pages.dev

Source: dorolisawsusie.pages.dev

2024 Tax Brackets Calculator Nedi Lorianne, 2023 income tax brackets by filing status: Efile your federal tax return now.

Source: theeconomicstandard.com

Source: theeconomicstandard.com

IRS Announces Inflation Adjustments to 2022 Tax Brackets The Economic, How many tax brackets are there? Efile your federal tax return now.

More Guides And Other Resources.

The tax rate schedules for 2024 will be.

Individual Single Filers, Married Individuals Filing Jointly, Heads Of Households, And Married Individuals Filing.

Below are some highlights for 2024.